Among Alaska teens, nicotine consumption is on the rise, primarily through vapes and smokeless tobacco products like snuff or iqmik. Higher taxes on tobacco and other nicotine products are linked to lower consumption among young people. But the city council in Bethel is divided about whether to widen the scope of the city’s tax on tobacco to include non-tobacco nicotine products like vapes or nicotine pouches.

When Bethel City Council first approved a tobacco tax more than a decade ago in late 2012, council members said that they hoped the additional cost might discourage tobacco use in Bethel. But 12 years later, it’s not clear whether the tax has affected how many people purchase and consume tobacco in the city.

“As a tobacco user, and I have been a smoker and I don't plan on quitting anytime soon, you know, I kind of sat back and accepted everything that was thrown at smokers, with all these taxes and everything else and hiking the prices,” said Bethel City Council member Rose “Sugar” Henderson.

“It's not discouraging people from smoking,” Henderson said at a Feb. 13 meeting. “People are still smoking, they're just suffering in other ways. Because they have to take, if they're on a fixed budget, they have to take from one area to cover this area. It's ridiculous.”

According to the Alaska Department of Health, as of 2020, around 25% of adults in Alaska use tobacco or nicotine products in any given year. But in Southwest Alaska, that rate is almost double at 49%. In fact, the region has some of the highest adult tobacco and nicotine product consumption in the state.

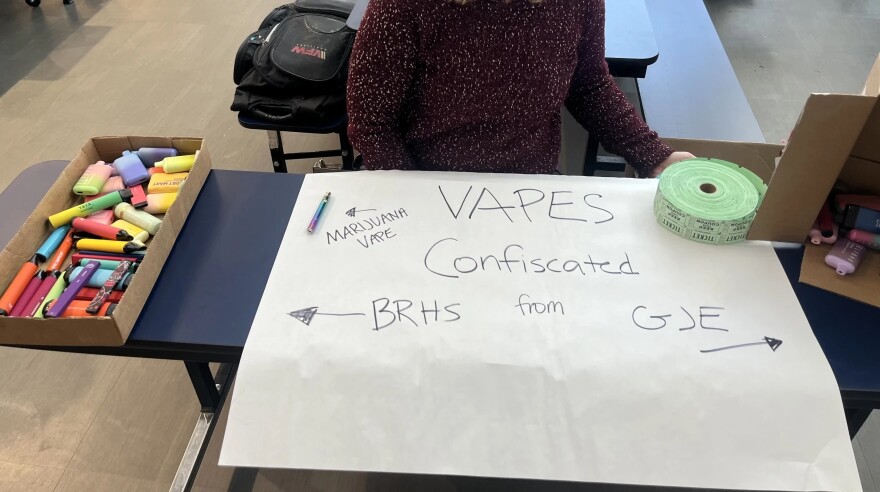

Of that total usage, vapes, smokeless tobacco products, and other non-tobacco nicotine products represent a small fraction. But in recent years, vape use has been on the rise among teenagers, even as it’s stayed level in adult populations.

An excise tax

In Bethel, tobacco products other than cigarettes are taxed by what’s called an excise tax: a tax on certain goods that’s paid by the distributor. Cigarettes are also taxed, but at a different rate.

As non-tobacco nicotine products have grown in popularity in recent years, other municipalities have been updating their codes to include all forms of nicotine under tobacco taxes, as Bethel City Clerk Lori Strickler explained to council members.

“We had a local store reach out to us on this occasion, and then a prior occasion asking if certain products fell under what is defined as tobacco by our code. And the Federal Drug Administration just last year amended their definition of tobacco products to include non-tobacco, like non-traditional tobacco products, and pulled in the chemical tobacco under their regulation,” said Strickler.

Nicotine products that aren’t tobacco, like vapes or nicotine pouches, aren’t currently taxed in Bethel in the same way as tobacco products like chewing tobacco or cigars.

But that could change after the council voted 4-3 on Feb. 13 in favor of holding a public hearing on a change to local code that would add vapes, nicotine pouches, and other non-tobacco nicotine products to the definition of tobacco. If passed, those products would be included in Bethel’s 45% tobacco excise tax.

Council members Henderson, Mikayla Miller, and Vice-Mayor Sophie Swope voted against the motion, while Mayor Mark Springer and council members Mary “Beth” Hessler, Teresa Keller, and Patrick Snow voted to bring the proposed change to a public hearing.

Small business concerns and discouraging kids from vaping

Bethel City Council member Henderson didn’t support the motion and said that she disagreed with lumping in vaping with nicotine products that can help people quit smoking or chewing tobacco.

“I agree how terrible vaping is. Vaping is worse than smoking a cigarette,” Henderson said. “But in throwing in vaping with these nicotine pouches that people are using, I don't think that's fair to those users. There are people who have quit chewing snuff and gone to these nicotine pouches.”

Henderson also said that she was concerned about the potential impact to Bethel’s small businesses that distribute nicotine products.

Jasmin Rios, a small business owner, was the sole member of the public to speak at the meeting. She said that she didn't want to add vapes and other non-tobacco nicotine products to the excise tax.

“[I’m] just concerned that an increase of more taxes, customers might resort to buying online,” Rios said. “And, you know, these purchases come alongside gasoline, food, beverages, and various other goods. And it could, you know, add for them to not go into the stores because we keep adding more taxes when it comes to tobacco products.”

Council member Hessler works at the Yukon-Kuskokwim Health Corporation and said that she’s seen first hand how addictive vaping can be for kids. She said that addressing that issue is her priority, not the potential revenue.

“I would not want the city to start thinking, ‘Oh, this is going to help us getting a lot of income,’” Hessler said. “But I would be for discouraging how easy it is to get.”

Bethel’s tobacco tax has brought in over half a million dollars per year since mid-2019.

Hessler said that she thinks keeping the tax even across tobacco and nicotine products is the balanced way to approach the problem.

“If we don't, and it's cheaper than the regular cigarettes and nicotine that's available, could our young people, or adults, whoever, just go to that more because of the cheapness of it?” Hessler asked. “I think it's fair to include that in the excise tax.”

While Bethel’s council mulls changes to the local tobacco excise tax, cancer survivors and anti-tobacco advocates spent much of Feb. 20 lobbying at the state capitol in Juneau for an across-the-board increase to state taxes on tobacco products.

In a press release, the American Cancer Society’s Cancer Action Network State Government Relations Director Emily Nenon said: “The Tobacco Industry is working to addict a new generation of customers and the legislature hasn’t raised tobacco taxes in 20 years. E-cigarettes weren’t even on the U.S. market 20 years ago. A comprehensive approach to tobacco prevention is critical to regaining ground, especially in youth prevention.”

Bethel City Council will hold a public hearing on the proposed new excise tax on Feb. 27.